Contents:

These prices will change over time based on factors that affect currency prices. As we mentioned, external market factors can have a significant impact on forex spreads in either direction. Fixed spreads generally stay the same and are offered by brokers that operate as a market maker or a dealing desk. As mentioned above, traders who are just starting out need to consider the spreads that brokers offer, and do so closely. The forex market differs from the New York Stock Exchange, where trading historically took place in a physical space. The forex market has always been virtual and functions more like the over-the-counter market for smaller stocks, where trades are facilitated by specialists called «market makers.»

Any short-term disruption to debt buyer is reflected in the spread. This refers to situations like macroeconomic data releases, the hours when major exchanges in the world are closed, or during major bank holidays. The liquidity of instrument allows to determine whether the spread will be relatively large or small. The brokers make money by selling a currency to the traders for more than what they pay to buy it. The tighter the spread, the sooner the price of the currency pair might move beyond the spread — so you’re more likely to make a gain. The spread is the cost of the forex transaction, and you’ll want to determine if that cost suits your trading style.

Start trading now with a live account to get access to exclusive features, such as our chart forum, live market data and Reuters/Morningstar reports, as well as stock trading. Practise trading the forex market risk-free with a demo account, using virtual funds. Try out what you’ve learned in this shares strategy article risk-free in your demo account. Learn how shares work – and discover the wide range of markets you can spread bet on – with IG Academy’s free ’introducing the financial markets’ course. The margin on a forex trade is usually only 3.33% of the value of the trade, which means you can make your capital go further while still getting exposure to the full value of the trade.

The Importance of the Spread When Trading

An indirect quote in the foreign exchange markets expresses the amount of foreign currency required to buy or sell one unit of the domestic currency. In the simple words, the spread depends on market liquidity of a given financial instrument i.e., the higher the turnover of a particular currency pair, the smaller the spread. For example, EUR/USD pair is the most traded pair; therefore, the spread in the EUR/USD pair is the lowest among all other pairs. Then there are other major pairs like USD/JPY, GBP/USD, AUD/USD, NZD/USD, USD/CAD, etc. In the case of exotic pairs, the spread is multiple times larger as compared to the major pairs and that’s all because of thin liquidity in exotic pairs.

Spread in other markets can be fixed, but forex will always exhibit variable spreads. Spread with FOREX.com can also vary depending on the account you have. Standard accounts will have larger spreads compared with more professional accounts. Brokers may widen the spread to make a profit from facilitating the trade, meaning the trader would pay more when buying or receive less when selling.

11 Best Low Spread Forex Brokers for April 2023 – Business 2 Community TR

11 Best Low Spread Forex Brokers for April 2023.

Posted: Thu, 15 Sep 2022 07:00:00 GMT [source]

One of the downsides of a variable spread is that, if the spread widens dramatically, your positions could be closed or you’ll be put on margin call. Keep an eye on our economic calendar to stay abreast of upcoming financial events. The spread in forex changes when the difference between the buy and sell price of a currency pair changes.

What are the Disadvantages of Trading With Fixed Spreads?

The broker basically resets the positions and provides either a credit or debit for the interest rate differential between the two currencies in the pairs being held. The trade carries on and the trader doesn’t need to deliver or settle the transaction. When the trade is closed the trader realizes a profit or loss based on the original transaction price and the price at which the trade was closed. The rollover credits or debits could either add to this gain or detract from it. When trading in the forex market, you’re buying or selling the currency of a particular country, relative to another currency.

Best Forex Brokers 2023 – Forbes Advisor UK – Forbes

Best Forex Brokers 2023 – Forbes Advisor UK.

Posted: Tue, 31 Jan 2023 08:00:00 GMT [source]

Spreads are often priced as a single unit or as pairs on derivatives exchanges to ensure the simultaneous buying and selling of a security. Doing so eliminates execution risk wherein one part of the pair executes but another part fails. Spread trades are the act of purchasing one security and selling another related security as a unit. Usually, spread trades are done with options or futures contracts.

Factors that Influence the Foreign Exchange Spread

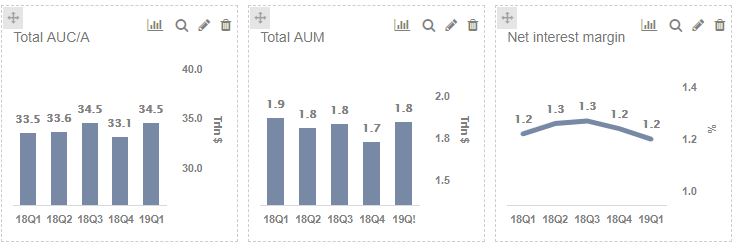

By default, the maximum and minimum spread for each time period is indicated by the green line, whereas the average is shown by the yellow circle. The current spread is shown on the right hand side of the indicator and highlighted in blue. Right click in the Market Watch window, scroll down to «Columns» and from here select «Spread». A new column will appear on the right in the window which displays the difference in value between the Bid and the Ask quotes for each trading instrument. While spreads can determine what broker you use, it doesn’t mean that they represent execution quality. It’s important to read reviews of the broker and test their system in order to judge their execution.

The brokers actually act as a counterparty to the trades of their clients. With the help of a dealing desk, the forex brokers are able to fix their spreads as they are able to control the prices that are displayed to their clients. We offer competitive spreads on a range of currency pairs, including major pairs such as EUR/USD and GBP/USD, starting at just 0.7 pips, or a forex margin rate of 3.3%. Discover forex trading with our award-winning trading platform, Next Generation. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Samantha Silberstein is a Certified Financial Planner, FINRA Series 7 and 63 licensed holder, State of California life, accident, and health insurance licensed agent, and CFA. She spends her days working with hundreds of employees from non-profit and higher education organizations on their personal financial plans. Most speculators don’t hold futures contracts until expiration, as that would require they deliver/settle the currency the contract represents. Instead, speculators buy and sell the contracts prior to expiration, realizing their profits or losses on their transactions. Unlike a forward, the terms of a futures contract are non-negotiable.

Therefore, currencies are quoted in terms of their price in another currency. The forex spread is the difference between the exchange rate that a forex broker sells a currency, and the rate at which the broker buys the currency. Such brokers buy large positions from liquidity providers and then offer those positions in small portions to the retail traders.

Spread in forex trading

A great deal of https://1investing.in/ trade exists to accommodate speculation on the direction of currency values. Traders profit from the price movement of a particular pair of currencies. A dual currency service allows investors to speculate on exchange rate movement between two currencies. The three components to a forex spread bet are direction of the trade, size of the bet, and the spread of the instrument to be traded. Traders who enter and exit the market regularly can see spread costs add up. If this sounds like your trading style, you need to ensure you are placing your orders at times when the spread size is optimal.

- Investing in the forex markets involves trading one currency in exchange for another at a preset exchange rate.

- When you’re making trades in the forex market, you’re buying the currency of one nation and simultaneously selling the currency of another nation.

- In other words, the asset comes with increased volatility and low liquidity.

- Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

Fixed spreads are usually offered by brokers that operate as a market maker or “dealing desk” model while variable spreads are offered by brokers operating a “non-dealing desk” model. Airport kiosks have the worst exchange rates, with extremely wide bid-ask spreads. It may be preferable to carry a small amount of foreign currency for your immediate needs and exchange bigger amounts at banks or dealers in the city. If you want to avoid a situation when spreads go too wide, then you should keep an eye on the forex news calendar.

The question of which is a better option between fixed and variable spreads depends on the need of the trader. Instead of charging a separate fee for making a trade, the cost is built into the buy and sell price of the currency pair you want to trade. However, you can mitigate the impact of these wide spreads by researching the best rates, foregoing airport currency kiosks and asking for better rates for larger amounts. In general, dealers in most countries will display exchange rates in direct form, or the amount of domestic currency required to buy one unit of a foreign currency.

Suppose also that the next traveler in line has just returned from their European vacation and wants to sell the euros that they have left over. They can sell the euros at the bid price of USD 1.30 and would receive USD 6,500 in exchange for their euros. In this type, spread comes from the market and the broker charges for its services on top of it. In this case, the broker has no risk because of liquidity disruption. The traders usually enjoy tight spreads except for volatile market movements. The spreads are set by the brokers and they do not change regardless of market conditions.

To start trading on some of the best currency pairs in the forex market, we have provided a list of suggestions here. The spread is mostly dictated by liquidity levels – how many people are involved in trading a currency pair. Higher activity in the market means a narrower spread, lower activity means a wider spread. This information has been prepared by IG, a trading name of IG Markets Limited. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result.

What is spread in Forex Trading?

Before news events, or during big shock , spreads can widen greatly. By shorting €100,000, the trader took in $115,000 for the short sale. When the euro fell, and the trader covered the short, it cost the trader only $110,000 to repurchase the currency. The difference between the money received on the short sale and the buy to cover it is the profit.

- You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

- As the foreign exchange spread decreases, so does the discrepancy between dealer and buyer valuations of the currency.

- Traders who want fast trade execution and need to avoid requotes will want to trade with variable spreads.

When trading currencies, you will see the spread indicated as a curve that shows its direction in references to the ask or bid price. Forex spreads can be affected by a variety of factors ranging from market liquidity, major economic news, and other events that may result in fluctuation. Historically, foreign exchange market participation was for governments, large companies, and hedge funds. In today’s world, trading currencies is as easy as a click of a mouse and accessibility is not an issue. Manyinvestment companies allow individuals to open accounts and trade currencies through their platforms.

Best Pairs to Trade in Forex in April 2023 – Business 2 Community TR

Best Pairs to Trade in Forex in April 2023.

Posted: Thu, 15 Sep 2022 07:00:00 GMT [source]

This kind of spread is also used in credit default swaps to measure credit spread. In many securities that feature a two-sided market, such as most stocks, there is a bid-ask spread that appears as the difference between the highest bid price and the lowest offer. The business day excludes Saturdays, Sundays, and legal holidays in either currency of the traded pair. During the Christmas and Easter season, some spot trades can take as long as six days to settle. Funds are exchanged on the settlement date, not the transaction date.